The Indian compressor market was valued at $1,943.4 million in 2019, and it is predicted to generate a revenue of $2,891.9 million by 2030. According to the estimates of the market research company, P&S Intelligence, the market will progress at a CAGR of 6.2% from 2020 to 2030. The expansion of the automotive industry is one of the major factors fueling the growth of the market.

According to the India Brand Equity Foundation (IBEF), the automotive industry in India will generate a revenue of Rs. 16.16-18.18 trillion (US$ 251.4-282.8 billion) by 2026. Additionally, the boom in the manufacturing sector, on account of the enactment of favorable government policies, is also predicted to propel the advancement of the market in the coming years. Besides, the inflow of huge foreign direct investments (FDI) is also driving the growth of the manufacturing sector in the country.

Owing to these factors, the manufacturing sector in the country will attain a value of $1 trillion by 2025, as per various estimates. In this industry, industrial air compressors are extensively used for tool stamping, powering, and clamping. This is credited to the surging requirement for these compressors in various industries, such as semiconductor, chemical, stee, and automotive.

In addition, these compressors are equipped with various features, such as better rotor profiles, and they are available in innovative designs, which is further boosting their popularity in the country. When lubrication type is taken into consideration, the market is categorized into oil-free and oil-flooded. Of these, the oil-flooded category dominated the market in 2019. This was because of the less maintenance requirements and low initial cost of these compressors in comparison to the oil-free ones.

The northern region dominated the Indian compressor market in 2019, and this trend is predicted to continue in the forthcoming years as well. This is ascribed to the expansion of the industrial manufacturing and automotive sectors in the region. Furthermore, the National Capital Region (NCR), which is situated in the northern part of the country, witnesses the large-scale usage of compressors, on account of the high automobile production and industrial growth. The region manufactures more than 30% of passenger cars and over 50% of two-wheelers in the country every year.

Hence, it is safe to say that the market will boom in the coming years, mainly because of the surge in the manufacturing and automotive sectors, owing to the implementation of favorable government policies in the country.

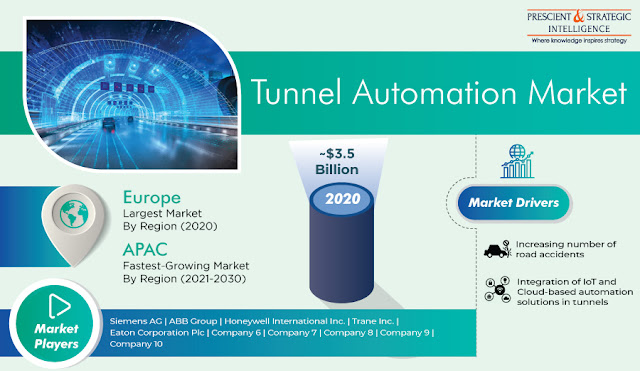

The global tunnel automation market reached a value of $3.5 billion in 2020, and it is expected to advance rapidly from 2021 to 2030 (forecast period). The major factors driving the expansion of the market are the enactment of stringent government regulations, surging requirement for improved road safety and security solutions, owing to the rising incidence of road accidents.

Besides the aforementioned factor, the increasing incorporation of cloud- and internet of things (IoT)-based automation solutions in tunnels is also driving the expansion of the tunnel automation market. Owing to their ability to provide an edge over conventional manual management methods, tunnel automation systems are being increasingly incorporated with technologies, such as cloud computing, data analytics, and the internet of things (IoT).

These technologies enable the sharing of data between communication systems and various other devices, such as sensors, lighting systems, and thermostats. Hence, the market will exhibit rapid expansion in the coming years, owing to the rising prevalence of road accidents and increasing tunnel construction activities all over the world.

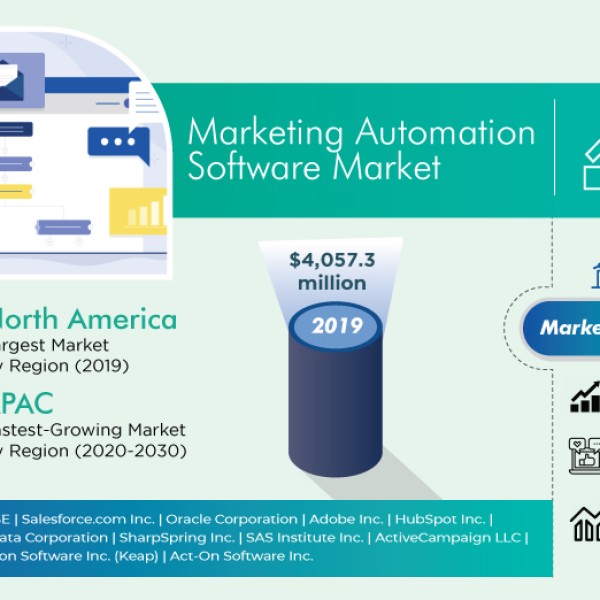

In recent years, marketing automation software has become an essential platform for every business-to-customer (B2C) and business-to-business (B2B) organization, due to its increasing use for lead generation and lead nurturing. Currently, the software requirement of these organizations is met by Oracle Corporation, Infusion Software Inc., Adobe Inc., SugarCRM Inc., Salesforce.com Inc., Liana Technologies Oy, Act-On Software Inc., IBM Corporation, HubSpot Inc., Acoustic L.P., Teradata Corporation, ActiveCampaign LLC, SAP SE, and SAS Institute Inc.

The industry segment of the marketing automation software market is classified into banking, financial services, and insurance (BFSI), information technology (IT) and telecom, media and entertainment, manufacturing, education, retail and e-commerce, healthcare, and others, including defense, government, automotive, aerospace, transportation and logistics, and travel and hospitality.

Among these, the retail and e-commerce category generated the highest revenue in 2019, due to the soaring consumer spending, increasing adoption of advanced technologies by retail firms, and growing internet penetration. Geographically, North America emerged as the largest user of marketing automation software in the preceding years, due to the presence of numerous software vendors, such as Adobe Inc., SharpSpring Inc., HubSpot Inc., and Oracle Corporation, in the region.

Additionally, the increasing shift of brands toward digital marketing platforms, mounting awareness about the utilization of automation solutions, surging need for personalized campaign management, rising advancements in cloud computing technology, and escalating use of automation tools in end-use industries, especially in the retail sector, will augment the adoption of the software in the region.

Whereas, the APAC marketing automation software market is set to undergo the most-rapid growth during the forecast period. This will be on account of the rising internet penetration, flourishing retail and e-commerce sector, increasing developments in the IT industry, soaring focus of brands on marketing their products on online platforms, burgeoning customer demand for advanced products, escalating need for recording real-time data insights to track consumer preference and offer improved experience, and mounting popularity of social media platforms, in the region.

Thus, the mushrooming demand for personalized products and rising implementation of digital media strategies will augment the adoption of marketing automation software.

Currently, the major players of the silicon on insulator market are taking strategic measures, such as product launches, facility expansions, partnerships, geographical expansions, client wins, and mergers and acquisitions, to gain a competitive edge in the market. For example, in January 2019, Soitec SA extended its collaboration with Samsung Foundry to increase the volume supply of FD-SOIs.